Inherited ira minimum distribution calculator

Open an inherited IRA. If you are not an eligible designated beneficiary or you inherited the IRA after 12312019 you fall under the new 10-year distribution rules.

Required Minimum Distribution Calculator Estimate Minimum Amount

Use our Inherited IRA calculator to find out if when and how much you.

. As a beneficiary you can transfer the money from any type of IRA to a new inherited IRA in your name. RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account. If the distribution was for a 2021 excess deferral your Form 1099-R should have code 8 in box 7.

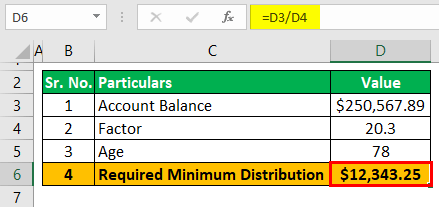

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA based on the IRS single life expectancy table. The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020.

If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum Distribution RMD. Rules for Inheriting a Traditional IRA. One inherited IRA tax management tip is to avoid immediately withdrawing a single lump sum from the IRA.

If you simply want to withdraw all of your inherited money right now and pay taxes you can. Make sure that any IRA withdrawals you do make are above the annual required minimum distribution RMD. If you are under 59½ youll be subject to the same distribution rules as if the IRA had been yours originally so you cannot take distributions without paying the 10 early withdrawal.

Get the facts about Inherited IRA withdrawal rules and distributions. Calculate the required minimum distribution from an inherited IRA. This included the first RMD which individuals may have delayed from 2019 until April 1 2020.

If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. As a beneficiary you cant make additional contributions but with an Inherited IRA the funds can remain tax-deferred and you can generally withdraw money right away. The RMD is the minimum amount an IRA stakeholder must take out of a plan after turning 705 years-old.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. Instead wait until RMDs are due or if you got the IRA from a non-spouse stretch withdrawals over 10 years. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

This value is based on the size of your account at the end of the preceding calendar year. Savers can choose either a Roth IRA or a traditional IRA for their rollover. Note that the minimum is different for spouses and non-spouse beneficiaries.

Please ensure that youre referring to the most current tables when calculating your RMD which can be found here under Calculating and taking your RMD or refer to the updated Single Life. Inherited IRA Tax Strategies. Starting the year you turn age 70-12.

The IRS implemented new Life Expectancy Tables on January 1 2022 for use in calculating required minimum distributions from accounts that qualify. Roth IRA calculator. In some situations the RMD rules for beneficiaries of IRA owners who died before 2020 are different than the RMD rules for beneficiaries of IRA owners who dies in 2020 and beyond.

If you want to simply take your inherited money right now and pay taxes you can. An inherited IRA is an individual retirement account opened when you inherit a tax-advantaged retirement plan including an IRA or a retirement-sponsored plan such as a 401k following the death. A required minimum distribution RMD is the amount that traditional SEP or SIMPLE IRA owners and qualified plan participants must begin distributing from.

Helps IRA beneficiaries calculate the required minimum distribution RMD amount that must be withdrawn this calendar year from an inherited IRA if applicable. They may be subject to the penalty if they take a distribution before age 59 12. 401k required minimum distributions start at age 70 12 or 72.

In some situations the RMD rules for beneficiaries of IRA owners who died before 2020 are different than the RMD rules for beneficiaries of IRA owners who died in 2020 and beyond. An Inherited IRA or a Beneficiary IRA is an account that is opened when someone inherits an IRA or employee-sponsored retirement plan after the death of the original owner. RMDs are taxable and can change your tax bracket and increase your overall tax burden.

Rules vary depending on whether you inherit an IRA from a spouse or non-spouse. Required Minimum Distribution - RMD. Traditional IRA calculator.

Withdrawals from Inherited Roth IRA If the inherited account was a Roth IRA any withdrawals of earnings taken prior to the point at which the original owner would have satisfied the 5-year rule will be subject to income tax though not the 10 penalty. Such as an IRA or 401k. Which means you can distribute the assets any way you want as long as all the assets have been distributed before the end of the 10th year.

Contributions are rolled over from a workplace retirement plan such as a 401k or 403b. The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and costly mistakes. A required minimum distribution is a specific amount of money a retiree must withdraw from a tax-deferred retirement account each year after age 72.

Helps IRA beneficiaries calculate the required minimum distribution RMD amount that must be withdrawn this calendar year from an inherited IRA if applicable. A required minimum distribution RMD is the minimum amount of money that a Traditional IRA holder is required to withdraw annually once they reach the RMD age threshold. If the distribution was for a 2021 excess deferral to a designated Roth account your Form 1099-R.

How much are you required to withdraw from your inherited retirement accounts. Aka Minimum Required Distribution Calculator. Note that the SECURE Act changed IRA rules in 2019 and now non-spouse beneficiaries must take money out of the account within 10 years of the owners death.

Understand how to calculate when you have to take RMD withdrawals from your 401k. Add the excess deferral amount to your wages on your 2021 tax return.

Ira Growth And Distribution Calculator Retirement Planning Tool

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Required Minimum Distribution Calculator Estimate Minimum Amount

Required Minimum Distribution Calculator Estimate Minimum Amount

The Mega Roth An Interesting Twist For Super Savers Under The Proposed New Secure Act Tax Free Savings Retirement Money Savers

Pin By Pinna Birdie On Financial Affairs In 2022 Inherited Ira Ira Roth Ira Contributions

Rmd Calculator Required Minimum Distributions Calculator

Rmd Table Rules Requirements By Account Type

Required Minimum Distribution Calculator

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Learn How To Calculate Online Advertising Rates To Make Money Blogging Inherited Ira Blog Advertising Money Blogging

Where Are Those New Rmd Tables For 2022

How To Calculate Rmds Forbes Advisor

Ira Required Minimum Distribution Table Sound Retirement Planning

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Rmd Table Rules Requirements By Account Type